The Texas electricity market reached unprecedented levels in November 2025, with power and utility deals surpassing $100 billion year-to-date according to Dallas News reporting. This surge reflects massive growth in data centers and artificial intelligence infrastructure, driving electricity demand to record highs across the state. The developments signal both opportunities and challenges for Texas homeowners seeking energy independence.

Record-Breaking Grid Activity and Infrastructure Investment

The $100 billion milestone represents the largest single-year investment in Texas electricity infrastructure since deregulation began. Data centers and AI facilities account for approximately 60% of new electricity demand, fundamentally reshaping grid planning requirements. ERCOT reports the Texas grid remains stable entering winter 2025, though operators maintain cautious monitoring protocols for potential severe weather events.

Texas A&M University has partnered with the grid operator to research how large electrical loads, including cryptocurrency mining and data processing facilities, impact overall system stability. This research addresses growing concerns about grid reliability as industrial electricity consumption continues climbing.

Renewable Energy Dominance Accelerates

Wind and solar energy now account for nearly 40% of Texas electricity generation, helping the state manage record demand while maintaining competitive pricing. Austin Energy has accelerated its local solar expansion program, approaching 2027 targets ahead of schedule due to strong residential adoption rates.

Battery storage capacity approaches 10 gigawatts statewide, providing critical grid stability during peak demand periods. These storage systems have proven essential for managing price spikes and avoiding potential blackouts during extreme weather conditions. The integration of renewables with battery storage demonstrates Texas leadership in clean energy infrastructure.

ERCOT data indicates renewable energy sources consistently outperform traditional generation during peak summer and winter demand periods. Solar installations provide daytime generation that aligns with air conditioning loads, while wind generation typically peaks during evening hours when residential demand remains elevated.

Solar Industry Consolidation and Market Dynamics

The solar industry experienced significant consolidation activity in November 2025. SunPower completed its acquisition of Ambia Solar for $37.5 million, continuing its expansion strategy following bankruptcy restructuring. This acquisition represents broader industry trends toward consolidation among major players.

Utility-scale solar developers face financial pressure and potential restructuring as project financing becomes more challenging. However, residential solar installation companies maintain stable operations due to consistent homeowner demand and available financing options.

Solar corporate funding increased 14% year-over-year, indicating continued investor confidence in distributed solar energy systems. The residential market demonstrates particular strength as homeowners seek protection from rising electricity costs and grid reliability concerns.

ION Solar maintains steady operations throughout this industry turbulence, focusing on residential installations that provide long-term value for Texas homeowners. The company's regional approach contrasts with national players experiencing operational challenges during market consolidation.

Federal Incentive Deadline Approaches

The federal Residential Clean Energy Tax Credit provides a 30% reduction on solar system costs through December 31, 2025. This incentive expires permanently after the deadline, representing the final opportunity for substantial federal savings on residential solar installations.

A typical Texas solar installation costs approximately $11,375 for a 5 kW system after applying federal tax credits. The average payback period remains 5 years, significantly shorter than the national average of 7 years. Over 20 years, homeowners can expect net savings of approximately $30,632 from properly sized systems.

Texas property tax exemptions protect solar installations from increased assessments, ensuring panels do not raise annual property tax obligations. This exemption remains in effect for the operational lifetime of qualifying systems.

Utility Rebate Programs Expand Availability

Texas utilities continue offering robust rebate programs that reduce initial solar investment costs:

AEP provides rebates up to $3,000 through the SMART Source Solar PV Program, with tiered amounts based on system capacity. Austin Energy offers qualifying customers $2,500 rebates, with additional $2,500 available for Sunset Valley residents.

Oncor expanded its Solar PV Standard Offer program, paying up to $9,000 distributed over five annual payments for qualifying installations. Houston-area customers access $135 per installed kilowatt, up to $3,000 maximum, on a first-come, first-served basis.

New Braunfels Utilities and San Marcos utilities both provide rebates up to $3,000 for qualifying residential systems. These programs specifically target homeowner installations rather than commercial projects.

Rising Electricity Rates Drive Solar Adoption

Texas electricity rates increased 23% from 2021 to 2024, creating strong incentives for homeowners to secure predictable energy costs through solar installations. A typical 9.72 kW system costs approximately $27,296 and generates approximately $79,000 in savings over 25 years when rising grid electricity costs are factored into calculations.

Solar buyback programs credit excess energy returned to the grid, though rates vary significantly by utility provider and region. TXU Energy's solar buyback rates range from 3.5 cents to 6 cents per kilowatt-hour as of November 2025. Deregulated market areas often base buyback rates on real-time wholesale prices.

Some renewable energy providers, including Gexa and Octopus, removed restrictive "use-it-or-lose-it" policies following customer feedback. These policy changes improve the economics of residential solar installations by ensuring homeowners receive credit for all excess generation.

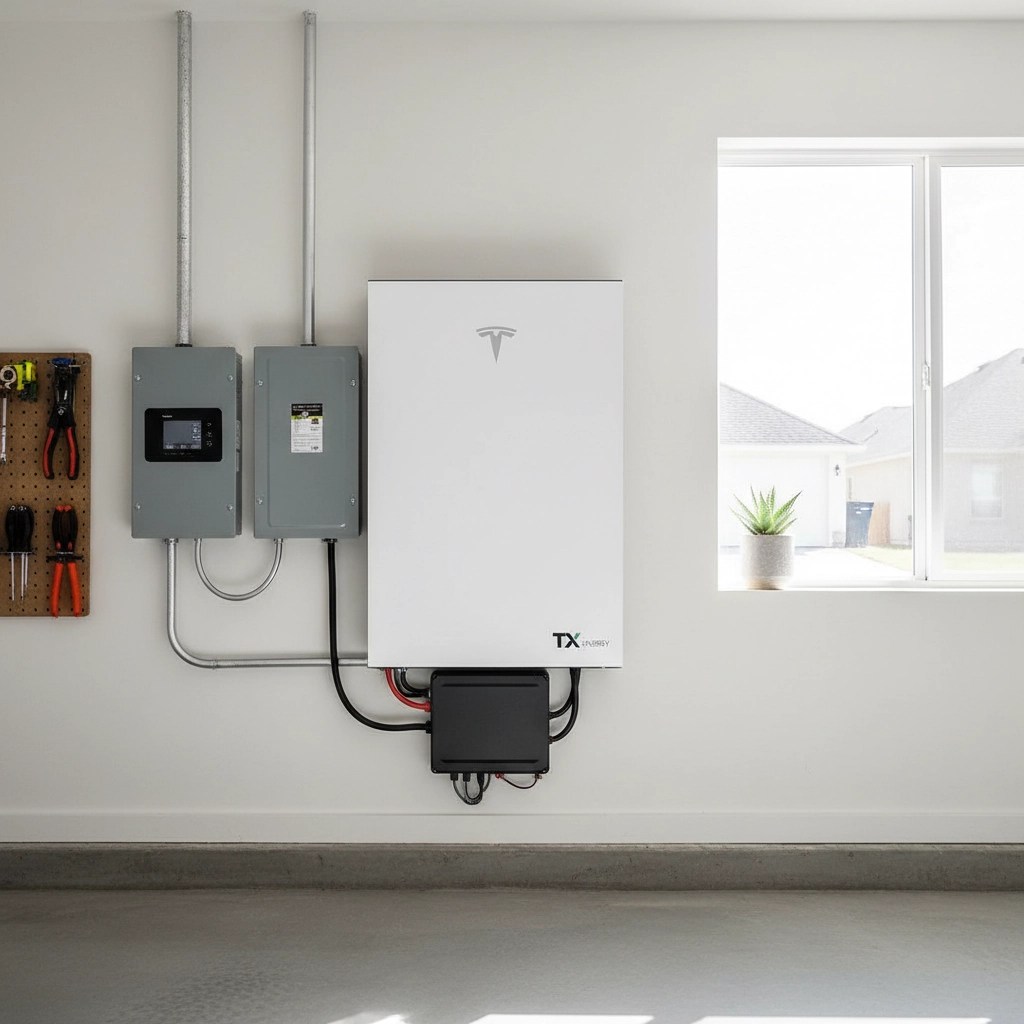

Home Solar and Battery Systems Provide Grid Resilience

The combination of solar panels and battery storage offers Texas homeowners protection against grid instability and rising electricity costs. Battery systems provide backup power during outages while enabling load shifting to minimize peak-hour electricity consumption.

Recent winter storm events demonstrated the value of distributed energy resources for maintaining residential power during grid stress periods. Homes equipped with solar and battery systems maintained electricity service while surrounding areas experienced extended outages.

Battery technology costs have decreased significantly, making combined solar and storage systems financially viable for most Texas homeowners. These systems provide energy independence while contributing to overall grid stability through distributed generation and storage capacity.

ION Solar's Position in the Evolving Market

ION Solar continues serving Texas homeowners throughout industry consolidation and grid modernization efforts. The company's focus on residential installations provides stability compared to utility-scale developers facing financing challenges and market volatility.

Customer reviews and installation process transparency distinguish ION Solar from competitors experiencing operational difficulties during market transitions. The company maintains consistent service delivery while national players restructure operations and financing arrangements.

Local expertise in Texas utility programs and interconnection requirements enables efficient project completion and maximum incentive capture for homeowners. This regional knowledge becomes increasingly valuable as utility programs evolve and grid requirements change.

2025 Represents Optimal Investment Timing

Multiple factors align to make 2025 the optimal year for Texas solar investment. The federal 30% tax credit expires permanently after December 31, 2025. Utility rebate programs remain well-funded and available. Electricity rates continue rising, strengthening solar's long-term value proposition.

Combined with 5-year payback periods and net 20-year savings exceeding $30,000, residential solar provides compelling returns compared to grid electricity costs. Property tax exemptions protect investments from increased assessments throughout system operational lifetimes.

The convergence of expiring federal incentives, expanding utility programs, and rising electricity costs creates a limited-time opportunity for Texas homeowners to achieve maximum solar investment returns while contributing to grid resilience and energy independence.

Rob Gonzalez – Manager DFW | 9566482089 | robert.gonzalez@ionsolar.com